AppToPay app for iPhone and iPad

AppToPay is an app based consumer finance product that has been created to eliminate the most frustrating elements of obtaining goods on interest free finance while shopping in your favourite retail stores, giving shoppers a ‘one-stop’ solution that takes care of credit approval, setting up monthly payments, budget control and consumer cover.

If you have applied for traditional forms of consumer credit in the past, such as in-store interest-free loans or store cards, you will have noticed that they take a lot of time to process. First of all, a sales advisor has to take all of your personal and financial details, and then there is the lengthy wait for approval from the store’s retail finance partner and the possibility of an embarrassing in declined application.

AppToPay cuts this whole process down to just a few moments because shoppers can register and establish a credit limit before they hit the shops, meaning that obtaining the goods on finance is as simple as a regular cash or card transaction.

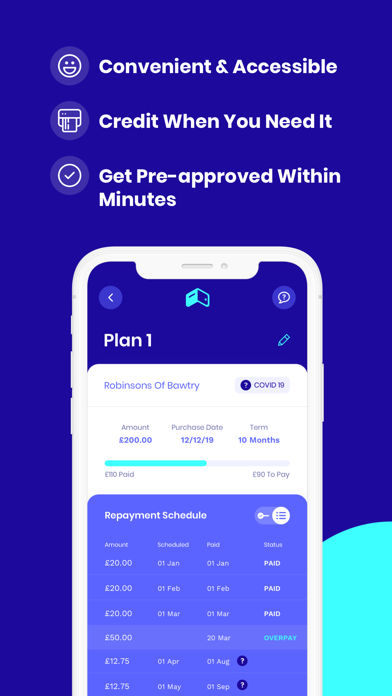

For each purchase that is made using AppToPay, the user can choose the repayment term between two months and twelve months without having to start the credit application process all over again - store cards, credit cards and finance agreements are usually fixed from the very beginning in this respect.

There are no interest fees to pay, provided that consumers keep up with the necessary payments by direct debit, and although this is a brand new approach to retail finance the all-important Section 75 cover still applies for account holders. This gives absolute peace of mind that purchasers are covered in the same manner as those with more traditional forms of credit.

The AppToPay app itself is laid out in a way that gives users instant access to the information that they need to plan their monthly outgoings effectively, and it is ultra-secure due to its integration with existing biometric security on smartphone devices, significantly cutting the risk of fraudulent transactions.